Trend analysis

Trends affecting our business

We respond to the relevant trends we observe in the world in which we operate. Here we discuss both the opportunities arising from these trends and potential threats to our market position.

Economy

In 2017 European and global growth rates were firmly back at pre-crisis levels. Overall in 2017, GDP in the Eurozone economies rose by 2.5 percent, the fastest growth rate since a 3.0 percent rise in 2007. GDP growth is expected to remain around 2.4 percent again in 2018, continuing the rate of growth at above pre-crisis levels1. Global recovery has also continued to strengthen with the broadest synchronised global growth upsurge since 20102. Private sector confidence at year-end 2017 was reported to be close to levels from the early 2000s, while the unemployment rate had declined to the lowest level since early 20093.

An upturn in the economy means an increase in mobility and that is an opportunity for Q-Park.

Political developments

The political arena in countries where Q-Park has a significant presence stabilised after the 2017 elections in the Netherlands, France and Germany. Uncertainty surrounding arrangements for the UK’s exit from the EU continued and the future of global trade with USA President Trump remains volatile. Increasing efforts by governments around the world to meet the Paris Climate agreements is a factor that we monitor continually and which is factored into our CSR strategy.

Trends affecting our society

Urbanisation

More than two-thirds of all Europeans live in urban areas. This is also where approximately 85 percent of GDP is generated. This increase in economic activity has consequences for the quality of life. Cities have to contend with congestion, traffic cruising for a place to park, reduced accessibility, air pollution, and unattractive and unsafe streets and squares, full of parked cars. To prevent economic activity coming to a standstill, municipalities are increasingly realising that it is essential to develop and pursue an integral mobility policy which includes:

- Urban mobility

- Smart parking tariff structures

- Attractive parking facilities

- Good use of limited space

- Accessibility to urban amenities

Q-Park works closely with municipalities to analyse mobility patterns and come up with innovative responses. We have parking capacity management systems in place for construction and operational use.

Demographics

Young people will continue to move from rural areas and smaller towns to bigger cities; the number of older people (60+) living in cities will rise as a result of general ageing and the fact that they move to city apartments when their children are grown, taking advantage of the leisure, culture, and health amenities on offer. This represents a growth opportunity for Q-Park as car ownership is high in this age group4.

Trends affecting mobility

Customer behaviour

With the rise in online shopping, the traditional shopping experience in town and city centres is evolving. Consumers make fewer physical visits to shop in town and city centres and when they do decide to ‘go shopping’ they turn it into a full-day ‘experience’ often followed by an evening out5.

This is shifting the pattern of physical shopping from smaller town locations to larger urban centres. This will create more demand for parking capacity management to improve access to the larger cities, with a corresponding fall in demand for locations in areas that are contracting.

To reduce our dependency on any one type of parking purpose, we are already increasingly focusing on providing our parking services at multifunctional inner-city locations that serve a range of amenities, such as offices, shops and leisure attractions, at public transport interchanges, and at hospitals.

Sustainable developments in inner cities

Larger cities are increasingly focusing on improving liveability and on sustainable mobility policies, both of which influence car usage and parking. Local authorities around Europe are constantly searching for ways to make their communities more liveable. Cars may be excluded from the urban environment, polluting cars refused access or taxed more heavily.

Major cities are taking steps to ban diesel cars from their city centres. Paris is also planning to double its bike lanes and limit select streets to electric cars by 2020. Oslo has announced plans to permanently ban all cars from its city centre by 2019, and Madrid plans to ban cars from 500 acres of its city centre by 2020.

Many cities are redesigning their city centres for walking and cycling rather than driving, with Copenhagen and Brussels in the lead as the largest car-free zones in Europe6.

Q-Park has recognised this trend for many years and has adopted a CSR strategy in a way that measures our progress on these developments.

Parking facilities are more expensive to build and maintain but are more sustainable than on-street and off-street parking. In return for the higher cost of construction, operation, and maintenance, multi-storey and underground car parks contribute to pedestrian-friendly and high-quality public spaces.

Q-Park also provides facilities for electric vehicle charging in many of its owned and long-leased facilities as well as ensuring bicycle parking facilities in new build parking schemes such as the Handelsbeurs in Antwerp.

Sharing economy

As municipalities increasingly impose measures to nudge people towards lower car use in city centres, it is logical that young people in particular are embracing car sharing as part of the wider trend towards the sharing economy.

Young people who live in large cities have less need for a car, particularly when there are sufficient alternatives such as good public transport or cycling routes. The actual number of shared cars is still low compared to the total number of cars on the road and the associated growth outlook7.

In our stakeholder dialogues, we hear many questions on the trend towards the sharing economy and more specifically car sharing. As a strong supporter of initiatives to support sustainable mobility, Q-Park already focuses on providing parking spaces to car sharing service providers and their customers.

Electric cars

While the number of electric cars is rising in some countries, especially in Norway, the Netherlands and France8, there are a number of constraints to sharp growth: battery technology, market acceptance, and concerns about the environmental impact of the electricity needed to charge them.

Despite fiscal incentive policies in some countries, consumers have not yet embraced the electric car on a large scale. Governments are now withdrawing fiscal advantages, so acceptance is likely to decrease even more.

Electric car charging is not new, this is Detroit in1919.

We provide 1,117 charging points at Q-Park facilities, which enables us to meet the growth in our customers' charging requirements.

Autonomous vehicles

The development of full autonomous vehicles (AVs) for private and shared use requires a huge technological leap and investment from car manufacturers. It also poses major infrastructure challenges to spatial planners.

AVs have the potential to be a true disrupter in the automotive industry and in the public transport and infrastructure domains. This development has far-reaching implications which are currently being debated by manufacturers, consumer groups, insurers, lawyers, and politicians9.

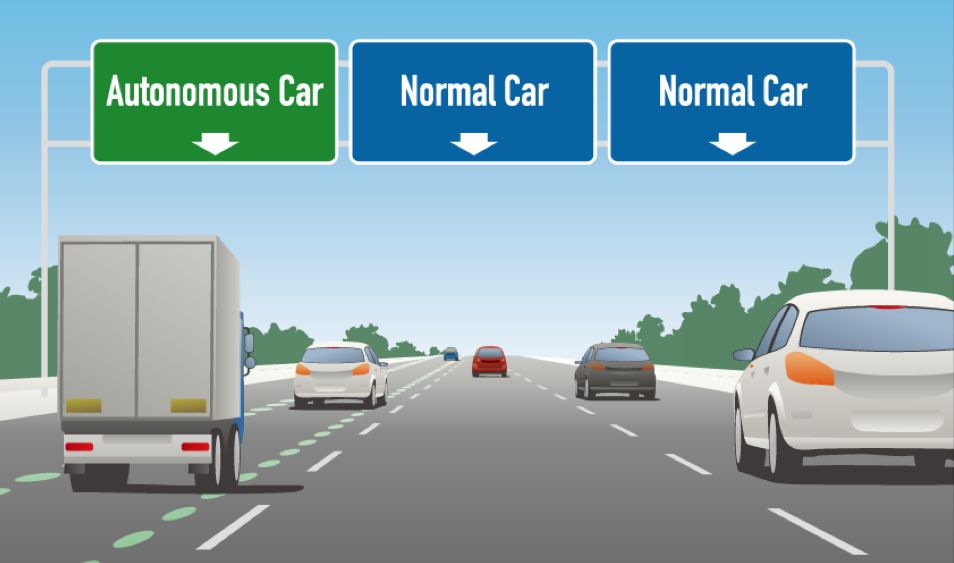

In the medium to longer term, full AVs may form an influential trend. We anticipate the first commercial applications by as early as 2020, while the first autonomous motorway is expected in 203010. This will really take off somewhere around 2040, and will culminate in a completely self-driving ecosystem, perhaps by 2050.

We are keeping close track of these developments, as we anticipate that our parking facilities will form an essential and practical part of sustainable autonomous mobility.

But first, lanes need to be separated to facilitate AVs.

Technology trends

Payment systems

Customers are becoming increasingly ‘digitised’: They expect to pre-book a parking space online, receive an e-invoice, and be able to pay online.

They are happy to identify themselves through automatic number plate recognition if that makes entering and exiting a parking facility quicker and safer. And increasingly they are happy to pay for parking by means of an app or a bankcard in preference to cash.

In response to digital and payment trends, changes in customer needs and behaviour, and the evolution of smart cities, we are constantly developing our parking management systems and our operational processes. We now offer various cashless and contactless payment options at all our parking facilities.

Up-to-date information

Motorists expect to see the nearest car park to their destination on their mobile devices. More and more information is becoming available to them to direct them to an available parking space while they are driving.

The expectation is that local initiatives will be integrated into nationwide information systems in the near future, although this will apply only to purpose-built parking facilities and off-street car parking. Q-Park is at the forefront of these developments and already provides information via such systems.

Online services

Online services are essential for the future of the parking market. Think of pre-booking and paying for a parking space online, buying a parking season ticket, electronic invoices and payment options, a customer and partner portal, and targeted promotions in cooperation with partners (hotels, events, shopping centres).

Q-Park has developed a digital platform to offer all these services, and to gain greater knowledge about our customers and partners.

Digital enforcement

Larger cities are introducing systems to deal with parking enforcement digitally11. This results in a shift from pre-payment to post-payment, meaning that local authorities generate more income as willingness to pay for parking increases and the enforcement costs go down. Q-Park's response to this is to integrate on-street and off-street parking services to cater to local needs.

Cyber threats

In our increasingly digital world, cybersecurity is crucial. Companies no longer ask if they will be affected by a cyberattack, but when. In 2017 Q-Park was one of the thousands of companies hit by the global WannaCry ransomware. We responded rapidly and have applied the lessons learned from this incident. We will continually monitor and adjust the cyber resilience of our organisation and the services we provide.

- https://www.reuters.com/article/us-eurozone-economy/euro-zone-growth-at-10-year-high

- https://www.imf.org/en/Publications/WEO/Issues/2018/01/11/world-economic-outlook-update-january-2018

- https://blog.euromonitor.com/2017/12/eurozone-economic-outlook-q4-2017.html

- Boston Consulting Group

- https://www.raconteur.net/business/perfecting-the-shopping-experience

- http://www.businessinsider.com/cities-going-car-free-ban-2017-8?international=true&r=US&IR=T#madrids-planned-ban-is-even-more-extensive-2

- https://www.fastcoexist.com/3027876/millennials-dont-care-about-owning-cars-and-car-makers-cant-figure-out-why

- https://en.wikipedia.org/wiki/Electric_car_use_by_country, 2017

- http://q-park.com/blogs/newsitem/13542/avs-implementation-predictions

- http://www.driverless-future.com/?page_id=384

- http://www.parking-net.com/parking-news/safer-place/parking-enforcement-2016